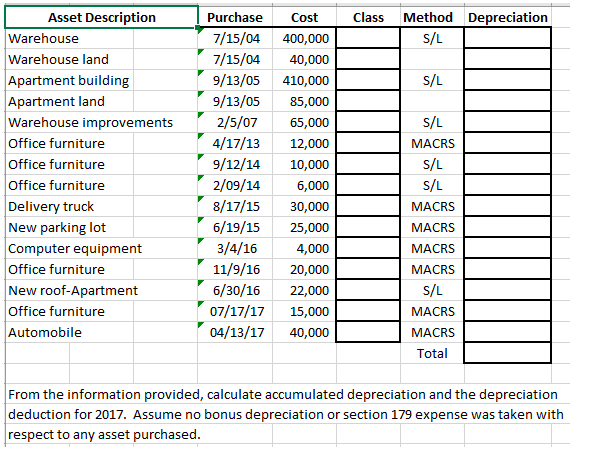

Standar Depreciation For Roof

If the roof is 10 years old at the time of your loss and it requires replacement we would subtract 40 depreciation 10 years x 4 a year from your replacement cost estimate to determine the acv of your roof.

Standar depreciation for roof. We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors. We have incurred costs for substantial work on our residential rental property. When a claims adjuster looks at a roof he will consider the condition of the roof as. Calculating depreciation based on age is straightforward.

How is depreciation on a roof calculated. The replacement cost of the roof and the expected lifetime of the roof for example the average cost to replace a roof is 10 000 and asphalt roofs generally have a lifespan of 15 years. For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property. What are the irs rules concerning depreciation.

A new roof is considered a capital improvement and therefore subject to its own depreciation. Some items may devalue more rapidly due to consumer preferences or technological advancements. Insurance valuation methods can be confusing and difficult to determine based on your individual needs and circumstances. The roof depreciates in value 5 for every year or 25 in this case.

The older the roof the more deducted for depreciation. As you can see in the above example doe will receive 14 000 from his insurance company whereas smith will receive only 4 000. If your dwelling has a 25 year composition shingle roof it would depreciate at 4 a year under normal conditions. The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged. The depreciation guide document should be used as a general guide only. Calculating depreciation begins with two factors. The full replacement cost of the roof is 10 000.

The insurance adjuster depreciated the roof 50 an arbitrary number based on its age so the actual cash value of the roof is now 5 000. The irs uses the straight line method to calculate the depreciation of your roof which means that the depreciation of your roof is calculated evenly across a set period of time.